#TURBOTAX 1099 SOFTWARE#

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge.Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Emerald Cash Rewards™ are credited on a monthly basis.H&R Block is a registered trademark of HRB Innovations, Inc.All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

#TURBOTAX 1099 FREE#

Additional terms and restrictions apply See Free In-person Audit Support for complete details.

It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

#TURBOTAX 1099 LICENSE#

W-2 import supports millions of employers and payroll providers.ĭriver’s License Barcode Scan: Another easy way for new customers to get a jump start on their taxes is to use the mobile app to simply scan the barcode on their driver’s license to quickly upload basic information - name, address, birthday. W-2 Snap and Autofill: Taxpayers can save time and jumpstart their taxes by importing their W-2 from their payroll providers or snapping a photo of their W-2, verifying their data and watching as their information is put on all their right tax forms for them. Free data transfer gives new and returning customers an effortless, worry-free head start to their taxes.įree Answers 24/7: Taxpayers can find personalized answers to their questions 24/7 from questions answered by our TurboTax Tax Experts and community.

#TURBOTAX 1099 FOR FREE#

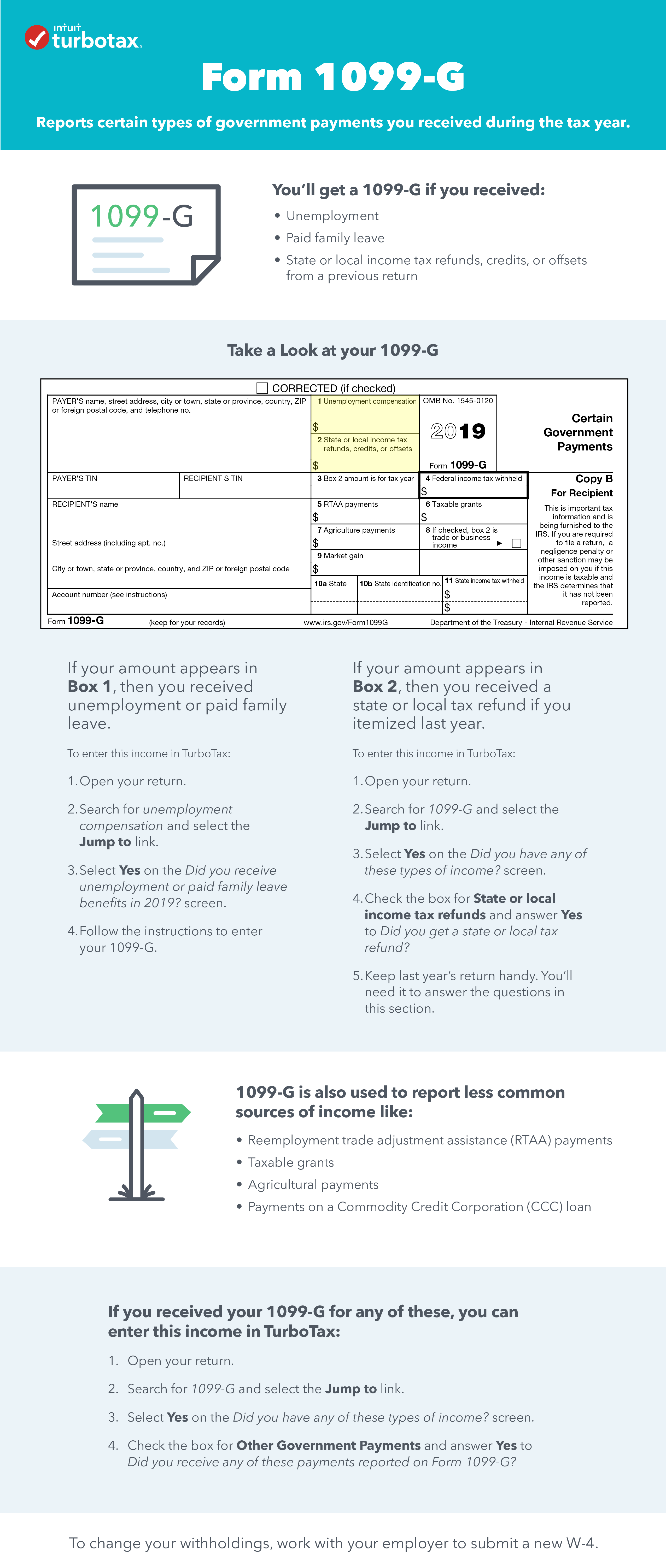

Eligible taxpayers can feel confident that they’re getting the most money possible in their pocket and that filing their taxes will be completely free.įree Data Transfer: Returning customers can easily transfer their prior-year information for free and new customers can effortlessly import a PDF of last year’s tax return and information for free, giving new and returning customers up to a 50% head start while eliminating data entry. Taxpayers are eligible for TurboTax Free Edition if they file a simple tax return (Form 1040/Form 1040-SR or Form 1040/Form 1040-SR + unemployment income only with no schedules): that includes W-2 income, limited interest and dividend income reported on a 1099-INT or 1099-DIV, claiming the standard deduction, Earned Income Tax Credit, the Child Tax Credit and unemployment income reported on Form 1099-G. TurboTax has helped millions of qualifying Americans file their federal and state taxes for free. That’s why, for the seventh year in a row, TurboTax is offering free federal and state tax filing with TurboTax Free Edition for filers with a simple tax return only. And what could be better than paying $0 to do your taxes? Absolutely nothing! TurboTax knows that your tax refund may be the biggest paycheck you receive all year.

0 kommentar(er)

0 kommentar(er)